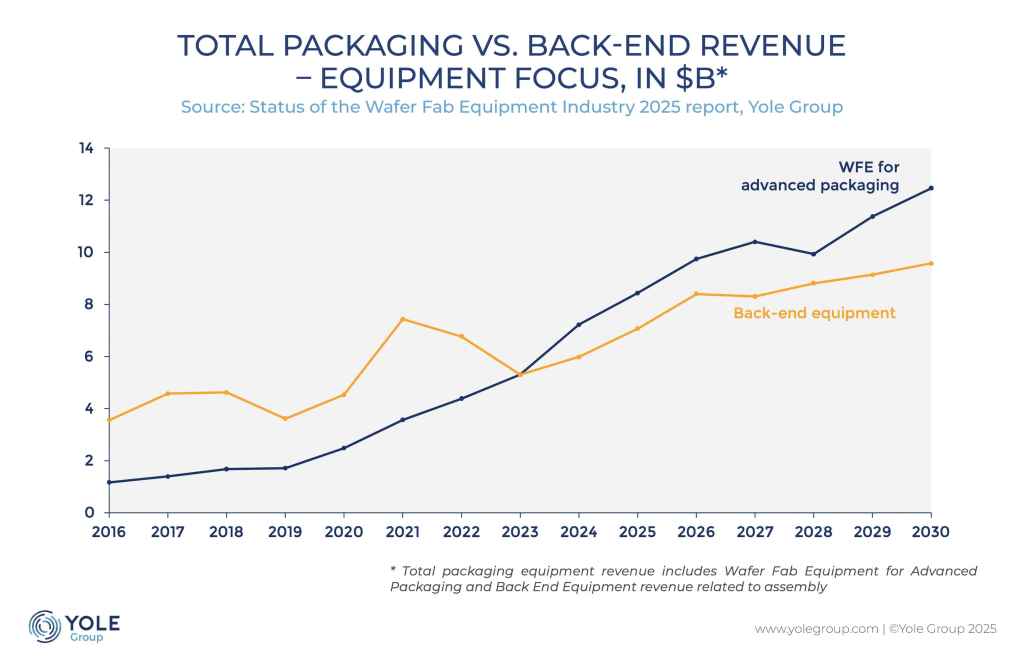

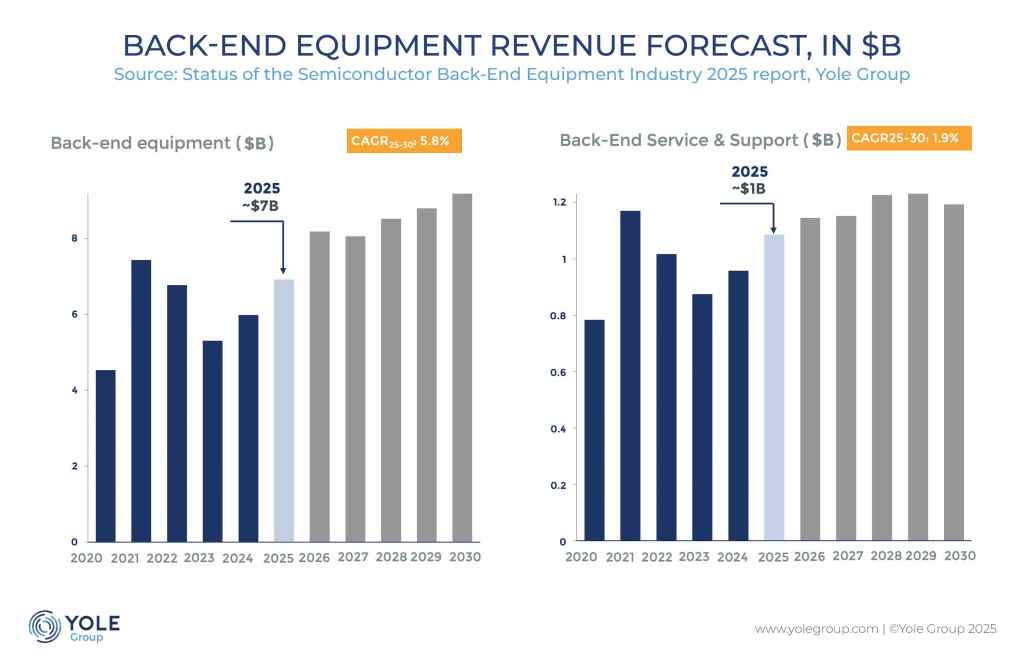

Yole Group announces the release of the first edition of its Status of the Back-End Equipment Industry 2025 report. This new publication offers analysis of a segment undergoing structural change, driven by the rise of advanced packaging, AI acceleration, and heterogeneous integration.

As the complexity of chip manufacturing moves beyond front-end scaling, back-end equipment has emerged as a strategic focus for semiconductor innovation. The report covers the entire value chain, including die bonders, Flip Chip bonders, TCB, hybrid bonding, wire bonding, wafer thinning, dicing, and metrology & inspection.

“This first edition marks a significant expansion of Yole Group’s coverage into the back-end equipment space. These technologies are now central to semiconductor performance scaling, especially for high-performance computing, AI, and next-generation memory,” said Vishal Saroha, Technology & Market Analyst, Semiconductor Equipment at Yole Group.

Bonding equipment: from supporting role to market driver

TCB and hybrid bonding are the fastest-growing equipment segments, reflecting the packaging shift toward chiplets and HBM-based architectures:

- TCB will reach $936 million by 2030, fuelled by integration in memory and AI platforms

- Hybrid bonding will grow to $397 million, with fine-pitch, high-density interconnects essential for advanced 3D integration

“Flip Chip bonders and die bonders remain at the core of high-volume and multi-market adoption, while wire bonding continues to serve cost-sensitive segments, growing steadily to support automotive, industrial, and legacy consumer applications,” explains Saroha.

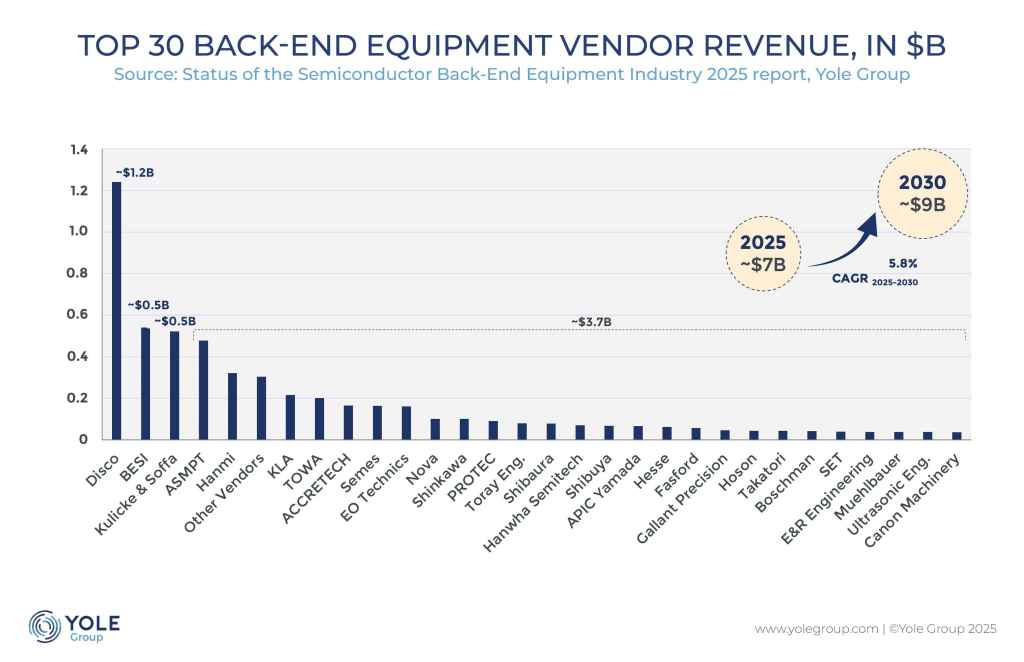

Competitive landscape and strategic moves

The back-end equipment ecosystem includes leading OSATs such as ASE, Amkor, JCET, and SPIL, as well as foundries and IDMs like TSMC, Intel, Samsung, SK Hynix, and Micron, all accelerating investment in bonding and integration technologies.

On the equipment side:

- BESI, ASMPT, Hanmi, DISCO, and K&S remain at the forefront of technology development

- Hanmi and Hanwha intensify competition in the TCB market, targeting memory IDM orders

- BESI’s delivery of five TCB systems and Applied Materials’ 9% stake in BESI illustrate increasing strategic alignment between tool vendors and system integrators

Strategy in a geopolitical era

The global back-end equipment supply chain continues to evolve under pressure from tariffs, export restrictions, and regional industrial policies. In response, leading vendors are pursuing:

- Geographic diversification of production to minimise regulatory and logistical risk

- Strategic technology partnerships to maintain access to advanced packaging capabilities

- Regional manufacturing localisation to align with customer proximity and government incentives

In China, domestic vendors currently satisfy less than 14% of internal back-end equipment demand, and while growth is expected, ecosystem maturity will take time, likely past 2030. IPOs, mergers, and supply chain realignments are already underway.

With the launch of this first report, Status of the Semiconductor Back-End Equipment Industry 2025, Yole Group brings its established expertise in semiconductor analysis to a fast-growing, increasingly strategic segment of the semiconductor industry. As packaging becomes a key performance enabler, back-end equipment is no longer an afterthought. “It is a battleground for innovation, capacity, and sovereignty,” state Yole Group’s Semiconductor Equipment analysts.