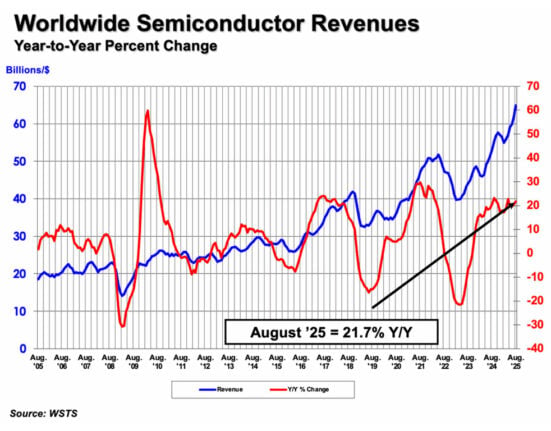

Global companies are expected to incur at least $1.2 trillion (£895bn; €1tn) in additional expenses during 2025, largely due to renewed US tariffs and the end of key trade exemptions, according to a new whitepaper from S&P Global Market Intelligence.

The analysis, based on forecasts from 15,000 sell-side analysts covering 9,000 listed firms, found that revenue expectations had increased, yet earnings projections had fallen – resulting in a 64-basis-point contraction in global profit margins. The total cost shock equated to $907 billion in lost profit across publicly tracked companies, with the remainder absorbed by smaller or privately held firms.

S&P Global’s researchers, Drew Bowers and Daniel Sandberg, noted that roughly two-thirds of the cost increase ($592bn) had been passed on to consumers through higher prices, with companies absorbing the remaining $315 billion. However, with smaller firms experiencing margin contractions of up to 165 basis points, the report cautioned that $1.2 trillion was likely a conservative estimate.

The study identified multiple drivers for this margin squeeze:

- The mid-2025 termination of the US ‘de minimis’ rule, which had exempted parcels under $800 from import duties, removed what the report called a “pressure relief valve” for global trade. Shipments per container from China reportedly fell by half once the rule was withdrawn

- Tariffs and logistics bottlenecks added layers of cost to supply chains

- Rising wages, energy prices, and AI infrastructure investment redirected profits towards labour, suppliers, and capital expenditure

Despite this, analysts did not see the contraction as permanent. S&P Global’s modelling suggested margins could recover to within 8-10 basis points of January 2025 expectations by 2027, assuming current cost pressures ease and firms adapt.

Regionally, Canada and China showed the greatest resilience, with margins remaining broadly stable. The US and Europe saw mid-level declines of around 54 basis points, while Asia (excluding China), the Middle East and Africa, and Latin America experienced sharper contractions.

The whitepaper also examined how cost pressures spread across supply chains. Firms with “supply chain tailwinds” – partners outperforming in their markets – were 10% less likely to suffer margin compression than those facing headwinds. The semiconductor sector offered a case in point: equipment maker KLA Corp shifted production routes away from China to Singapore, mitigating part of its tariff exposure.

S&P Global’s text analysis of 2025 earnings calls revealed a “tariff versus technology” tension. Companies expressing neutral tones towards both tariffs and AI were most likely to enjoy positive margin revisions. Overly negative or overly optimistic messaging tended to correspond with weaker results – suggesting investors rewarded balanced strategies and credible adaptation efforts.

Bowers and Sandberg concluded that while 2025 had locked in significant cost pressure, “belief curves” implied markets still viewed these shocks as temporary, not structural. The next two years will test whether global supply chains can rebalance or whether tariff-driven frictions will become embedded in corporate economics.