Copper prices have climbed sharply through late 2025 and into 2026. Reports indicate prices above $13,000 per tonne, driven by supply constraints and market demand.

Global copper demand grew 2.5% in the March quarter of 2025 compared to the same quarter in 2024. The main growth contributors were China (up 3%), the US (up 7.4%), and the EU (up 0.5%).

Some institutions expect that prices will ease modestly as markets adjust, reflecting short-term consolidation and weaker cyclical data, especially in China. However, brokerage forecasts project continued tightness and elevated price ranges throughout 2026.

The London Metal Exchange (LME) recorded record trading volumes in 2025 amid geopolitical tensions, tariff developments, and inventory movements.

Key impacted markets

Electrification

Copper demand continues to be underpinned by structural drivers associated with electrification of energy systems, grid expansion, renewable installations, and electric vehicles (EVs).

China, in particular, continues to build out the country’s electrical distribution network to connect new renewable energy sources and increase reliability. Recent Chinese economic stimulus measures, such as subsidies to purchase new electronic device such as smartphones and home appliances also support copper usage.

AI and data centres

Growth in artificial intelligence infrastructure, particularly data centres and associated electrical networks, is a new driver of copper demand.

AI data centres means more copper in substations, switchgear, transformers, busways, and heavy-gauge cabling. CRU estimates that copper demand from data centres could reach 260,000 tonnes in 2025 (up from 78,000 tonnes in 2020) and exceed 650,000 tonnes by 2030.

Semiconductor manufacturing

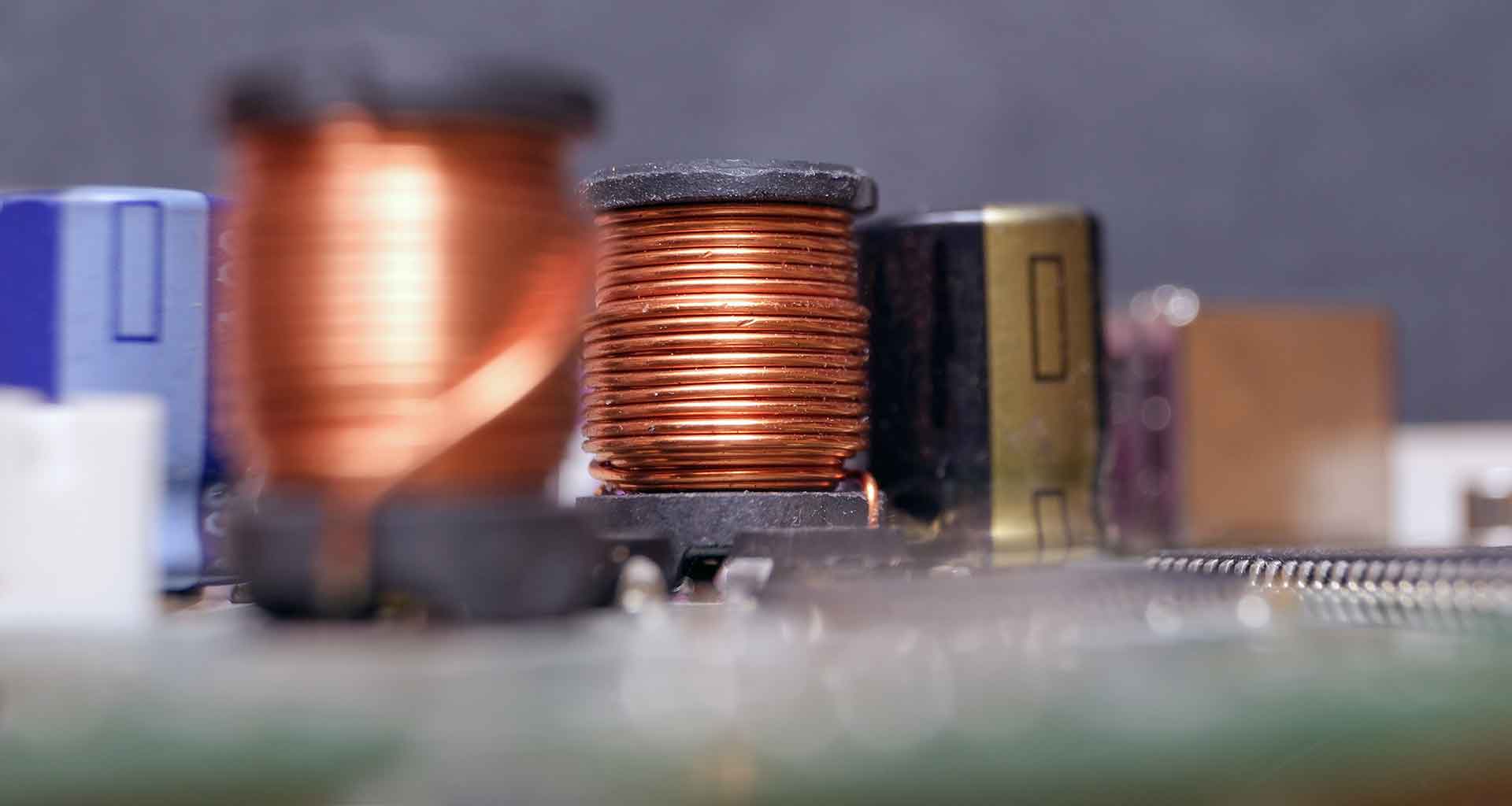

Copper remains a foundational material in semiconductor manufacturing, used extensively in interconnects, redistribution layers, through-silicon vias, lead frames, substrates, and advanced packaging. Elevated copper prices will directly increase bill-of-materials costs for wafer fabs and outsourced semiconductor assembly and test providers.

Over the outlook period to 2027, global copper demand is expected to rise by an average of 3% a year.

How to plan for 2026

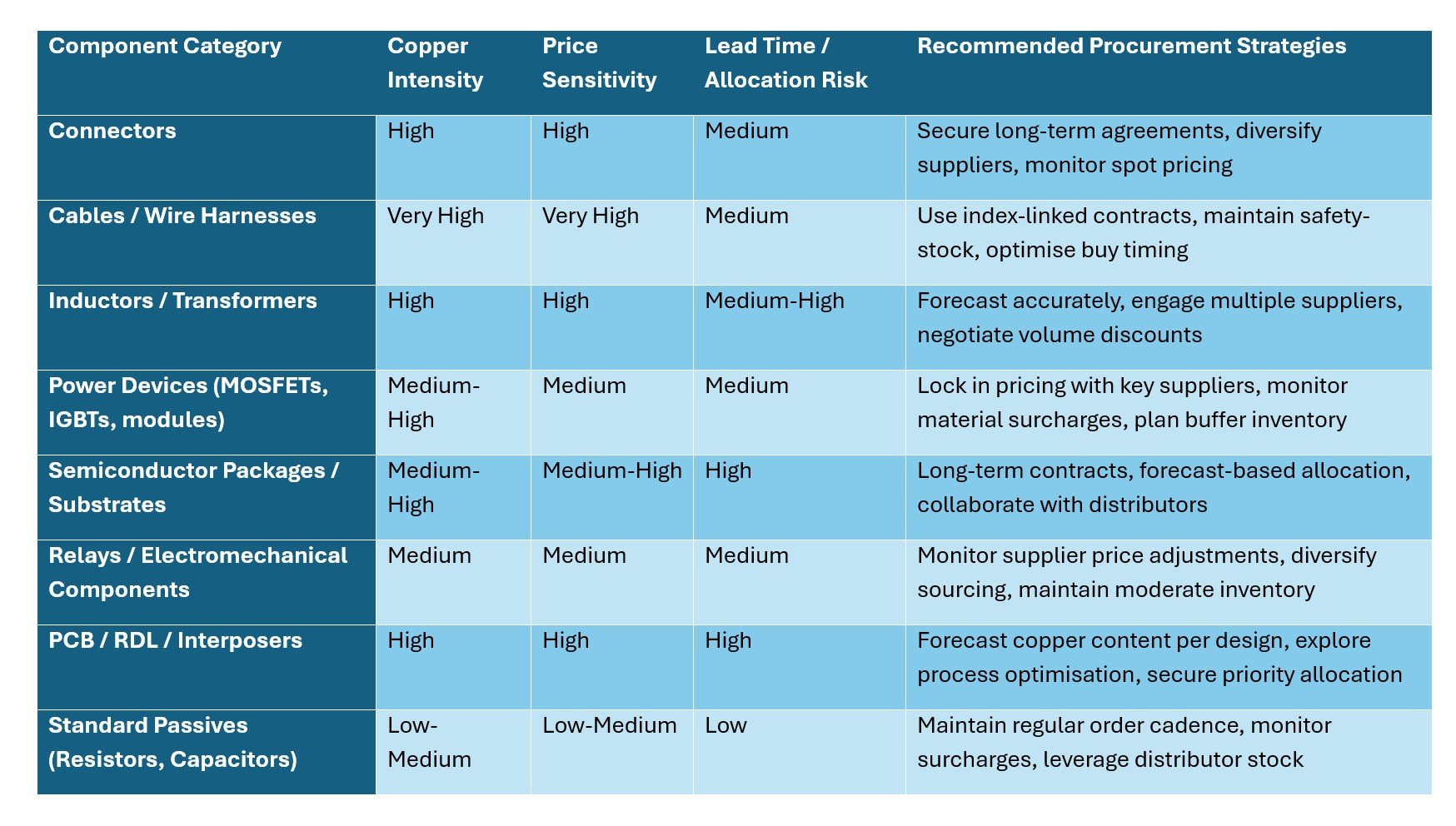

These elevated copper prices will ultimately increase cost bases across a wide range of components, especially those with high copper content such as connectors, cables, inductors, transformers, lead frames, substrates, and power devices.

IBS Electronics says the impact is less about metal prices themselves and more about how suppliers respond to sustained cost pressure.

During periods of rapid copper price movement, suppliers might prioritise higher-margin customers or long-term agreements, increasing allocation risk for spot buyers and smaller-volume customers.

What that means:

- More quote volatility: shorter price validity periods, tighter re-quote policies, and increased use of material-linked pricing adjustments

- Greater scrutiny of alternates: more frequent evaluation of equivalent parts and approved second sources, even when substitutions are limited by performance or compliance requirements

- Earlier cost visibility: BOM rollups increasingly need upfront checks for cost sensitivity in power-related components such as connectors, cables, magnetics, and power distribution hardware

I’d recommend the IBS BOM Tool which helps teams identify alternate sources, compare pricing across suppliers and regions, and assess supply risk at the BOM level so market volatility doesn’t become a last-minute disruption to production schedules.

Overall, my advice to procurement teams when it comes to navigating the copper shortage in 2026, is to focus on securing supply and controlling cost exposure.

Long-term contracts and indexed pricing help lock in supply and provide transparency, while buffer inventory and accurate forecasting reduce the risk of sudden price spikes or allocation delays. Diversifying suppliers and leveraging distributor networks further mitigates regional or single-source risks, ensuring continuity for copper-intensive components.