Yole Group announces the release of its new edition of the Power GaN report, Power GaN 2025. This provides an in-depth analysis of the global power GaN market trajectory, covering market values and volumes, supply chain dynamics, and technology innovations from 2020 to 2030.

The report’s objective is to deliver a comprehensive understanding of GaN’s growing role in the power electronics industry, from consumer applications to industrial, automotive, and data centre systems, and to identify emerging players, competitive strategies, and manufacturing capacities that will shape the market over the next decade.

Roy Dagher, Technology & Market Analyst, Compound Semiconductors at Yole Group said: “Power GaN is transitioning from promise to production reality. At Yole Group, we see an acceleration across all end markets. Its efficiency, compactness, and performance advantages make it a key technology for the next decade of power electronics.”

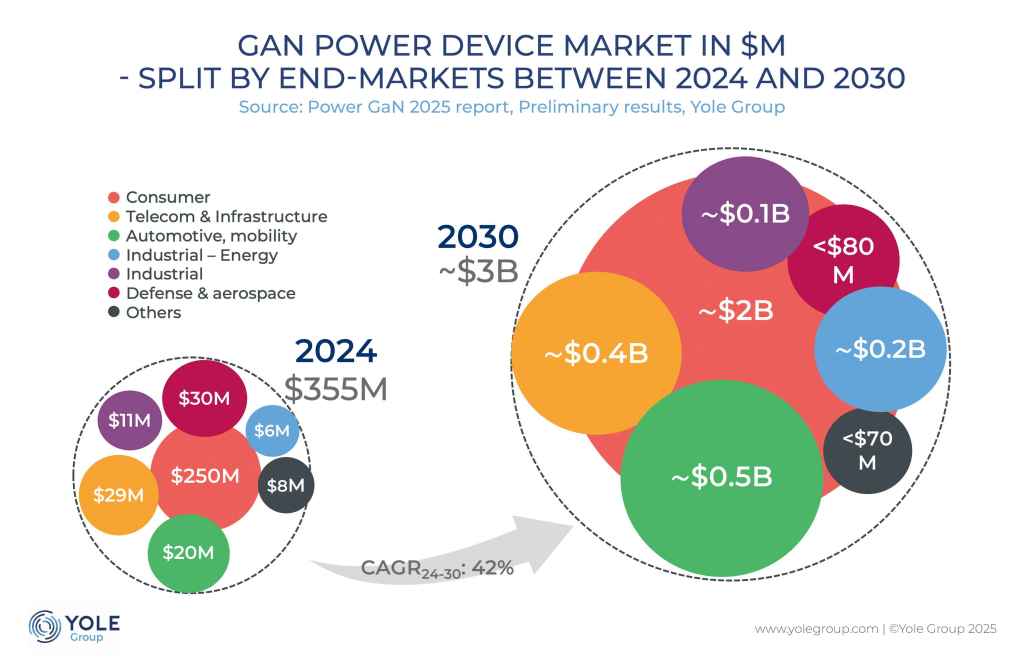

GaN has emerged as one of the most disruptive semiconductor technologies of the decade, with a market projected to reach about $3 billion by 2030. Consumer applications, particularly fast chargers, have been the early adopters, driving volume growth and ecosystem maturity. By 2030, the consumer and mobile segment is projected to constitute over 50% of the total power GaN device market.

Data centres: the golden road for GaN

The explosion in AI computing and data traffic is transforming data centre power architectures. The growing number of servers and communication systems is driving electricity demand and CO₂ emissions, intensifying the need for higher-efficiency power conversion.

GaN technology offers a compact, efficient, and thermally superior alternative to silicon-based systems. As detailed in the Power GaN 2025 report, GaN is particularly well-suited for PSUs above 3kW, delivering improved form factors, reduced heat losses, and lower operational costs.

In 2025, NVIDIA’s new data centre architecture announcement catalysed a wave of collaborations with leading power semiconductor manufacturers, including Texas Instruments, Navitas, Infineon Technologies, Innoscience, and onsemi. The aim is to integrate GaN devices into 800V HVDC power systems. These partnerships mark the beginning of large-scale GaN deployment, with Yole Group anticipating first commercial rollouts around 2027.

Together with telecom, these segments are expected to generate more than $380 million in GaN revenues by 2030, making data centres one of the most promising growth pillars of the power GaN market.

“Data centres represent a turning point for GaN,” adds Dagher. “The combination of AI, electrification, and sustainability goals makes GaN indispensable for next-generation server and telecom power systems.”

Other segments are gaining traction, with Enphase Energy’s first GaN-based microinverter and Changan Automobile’s first GaN-based OBC marking significant milestones that strengthen confidence in GaN technology and pave the way for wider penetration across the power electronics market.

Following the power GaN revolution

As the semiconductor industry strives for higher efficiency and sustainability, GaN stands at the core of the global energy and digital transition. From fast chargers to data centres and electric vehicles, power GaN is reshaping the way energy is converted and managed.

At the same time, the market is shifting toward IDM-driven business models – where vertical integration offers tighter control over technology and supply – as foundries remain essential to the industry’s growth. Established foundries are expanding their GaN capacity, and new entrants are emerging to serve fabless companies and IDMs seeking additional sourcing flexibility. This coexistence between integrated and foundry-based ecosystems is reinforcing the resilience and scalability of the global power GaN supply chain.

With the release of Power GaN Transistor Comparison 2025, Yole Group delivers an in-depth comparison of the leading GaN power devices, revealing how design choices and manufacturing strategies define competitive advantage in this rapidly evolving market.