Yole Group has published its new report, Data Centre Semiconductor Trends 2025, offering an in-depth analysis of how AI, HPC, and hyperscaler demand are driving a new semiconductor paradigm.

The semiconductor backbone of global Cloud and AI infrastructure is undergoing a profound shift. Yole Group’s Data Centre Semiconductor Trends 2025 reveals a market at an inflection point, driven by explosive AI growth and fundamental architectural change.

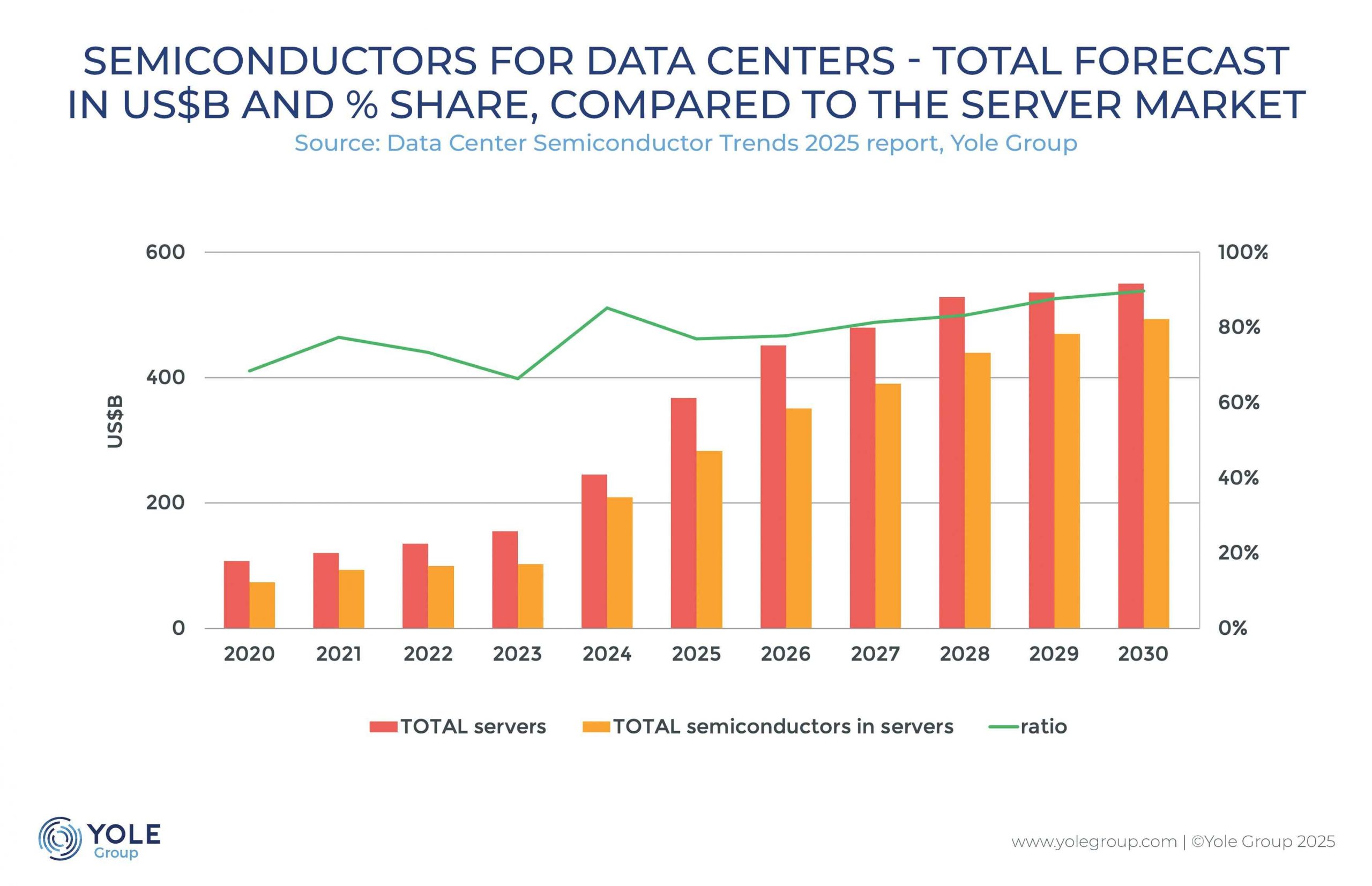

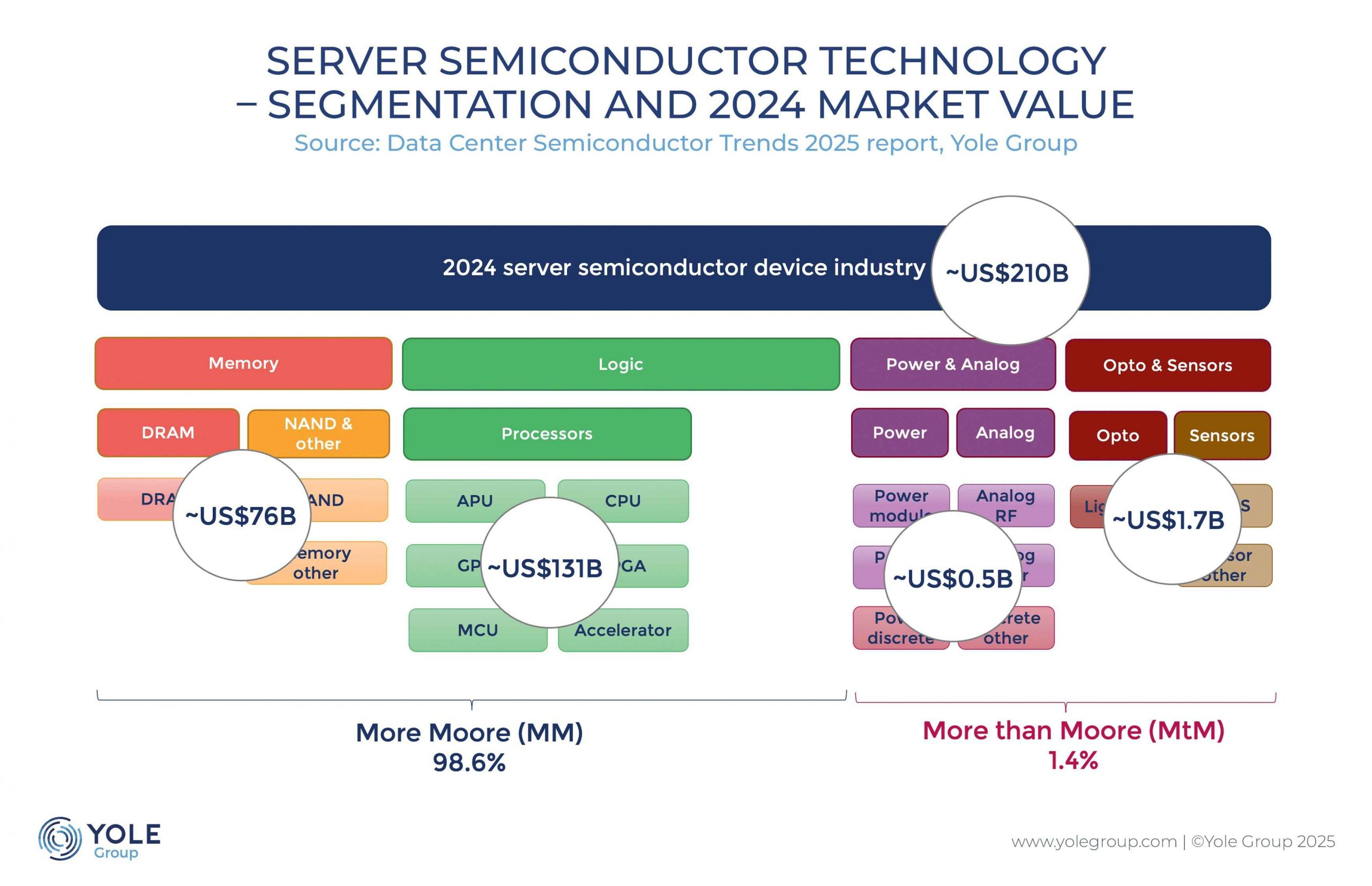

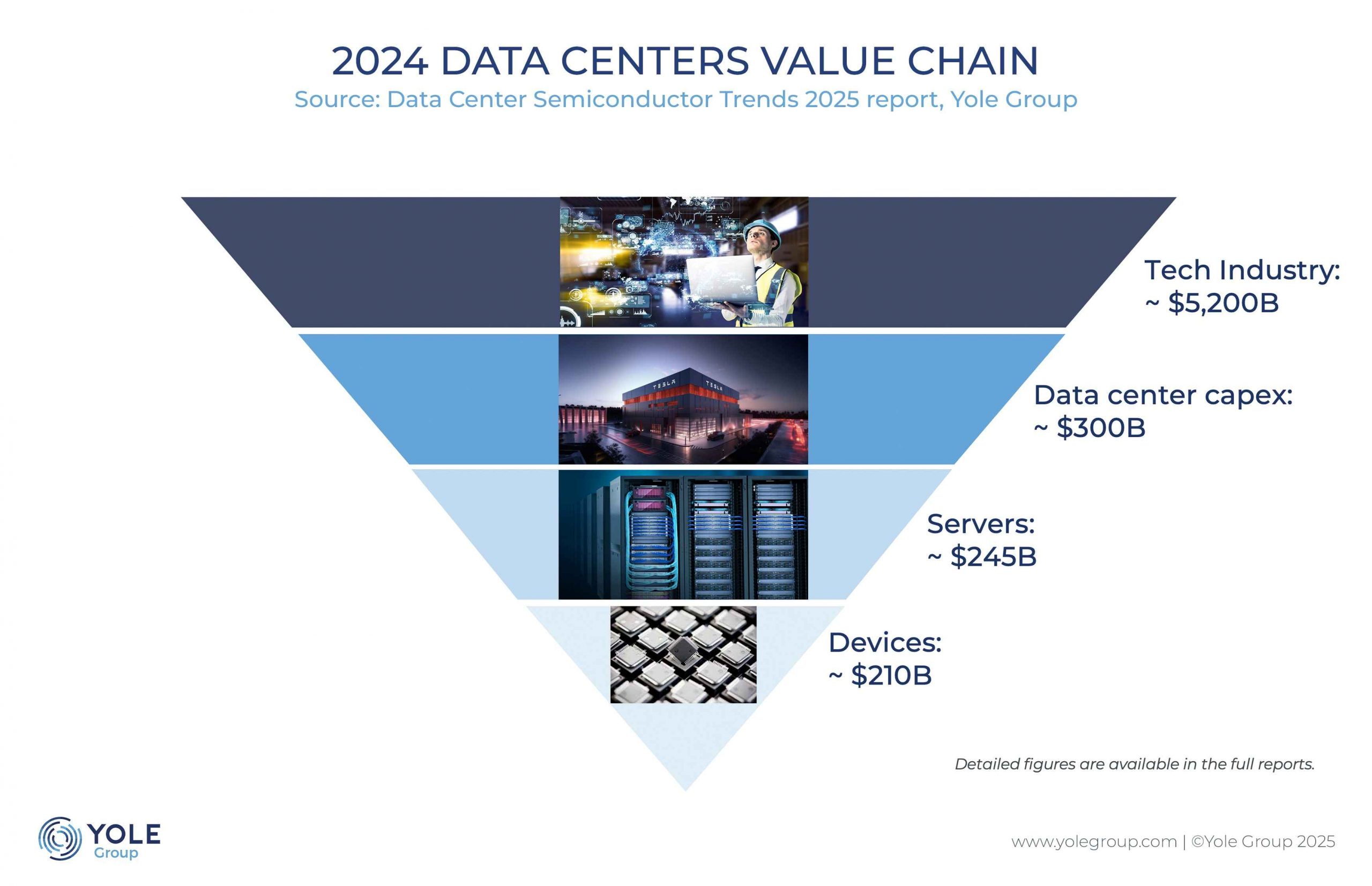

In 2024, the total semiconductor TAM for data centres reached $209 billion, spanning compute, memory, networking, and power. By 2030, that figure is projected to grow to nearly $500 billion. AI and HPC are now the dominant use cases, with Generative AI alone reshaping demand across processors and accelerators.

GPUs remain the cornerstone of AI infrastructure, with NVIDIA capturing 93% of the server GPU revenue in 2024. Yole Group, the market research & strategy consulting company, forecasts GPU revenue will grow from $100 billion in 2024 to $215 billion by 2030. Despite their high ASPs, GPUs are indispensable for AI training and are increasingly used in inference.

In this dynamic environment, AI ASICs are gaining momentum. Google, Amazon, and Microsoft are investing in domain-specific silicon to optimise performance and reduce dependence on NVIDIA. Based on the entrance of these leading companies, AI ASIC revenue is expected to skyrocket to $84.5 billion by 2030.

Compute is not the only bottleneck. Memory architecture is also evolving rapidly. DDR5 adoption continues. HBM is seeing exceptional demand, especially for AI training. CXL is gaining traction to solve memory disaggregation and latency challenges in new server architectures.

Leadership in data centre silicon is also shifting. US players remain dominant, especially Nvidia, AMD, and Intel. But Yole Group’s analysts point out that China is scaling up its domestic capabilities through strategic investment and policy. Export controls continue to impact supply chains but also reinforce sovereign development goals in China and beyond.

Startups and newcomers are also part of the game and shaping the market. From Groq to Cerebras and Tenstorrent, innovation in chip design is pushing the frontier of what AI inference hardware can do. Sometimes, novel solutions challenge established players on cost, performance, or energy efficiency.

“The data centre semiconductor industry is today investigating many approaches. At Yole Group, we investigated this domain in depth and analysed the innovations. Today’s solutions are all about control. AI workloads are reshaping what chips are built, how they’re packaged, and where they’re manufactured,” said Eric Mounier PhD, Chief Analyst, Photonics at Yole Group.