According to research from Counterpoint Research, the global semiconductor foundry market’s revneue grew 19% year-on-year in Q2 2025, predominantly driven by sustained AI demand on both advanced process and advanced packaging, and also benefited from pull-in demand by a China subsidy programme. This momentum will continue to accelerate, resulting in a mid-single digit QoQ revenue growth into Q3 2025.

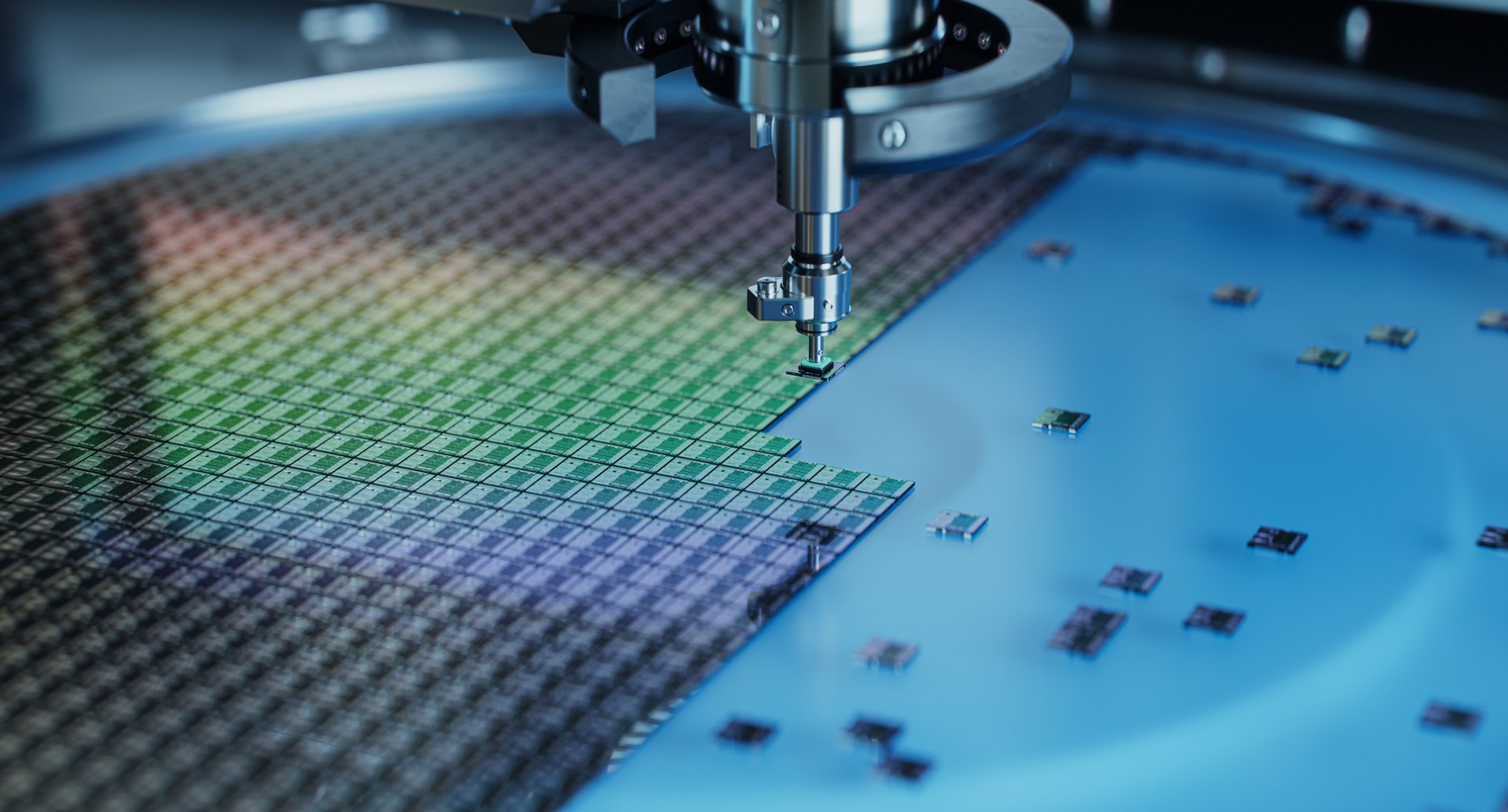

For the pure-foundry market, TSMC’s market share rose from 31% in Q2 2024 to 38% in Q2 2025, firmly maintaining its position as the market leader, and accounting for 75% of the YoY revenue growth in foundry 2.0 market in Q2 (vs.10% contribution from other pure-foundry players). The 44% YoY revenue growth was largely due to 3nm ramp up, high utilization rate in 4/5nm from AI GPU, and CoWoS expansion, which we believe will continue to be the major growth driver into H2 2025.

OSAT sector delivers a 11% YoY revenue growth in Q2 2025 (vs. 5% YoY in Q2 2024) as ASE contributed most of revenue growth, while KYEC delivered the strongest YoY growth (30%+ YoY), benefiting from AI GPUs. Advanced packaging is set to provide new growth momentum for OSAT companies. AI GPU and AI ASIC will be the major growth drivers for OSAT vendors in 2025/2026, with potential upside from incremental orders from other sectors. The revenue growth in Q2 echoes our views of advanced packaging set to provide new growth momentum for OSAT companies.

“As advanced packaging technologies gain importance, we believe chip vendors will increasingly rely on advanced packaging to enhance the performance of their chip solutions. Given TSMC’s current technological capabilities and strong customer relationships, the company is expected to remain not only a leader in advanced process node but also a front-runner in advanced packaging for the foreseeable future,” said William Li, Senior Analyst, Counterpoint Research.

Non-memory IDMs returned to a 2% revenue growth in Q2 2025 (from -9% YoY in Q2 2024), mainly driven by Texas Instrument’s 16% YoY revenue expansion. Due to clients’ inventories being at a relatively low level, orders’ visibility was relatively solid compared to previous quarter, and there continues to be a warm recovery in industrial sector, which will likely drive the revenue growth. However, automotive sector have yet to show a significant order recovery in H1 2025, and the rebound is slated to arrive in H2.

“The traditional peak season for consumer electronics, the accelerating AI applications/orders, and the existing subsidy policy in the Chinese market will be major drivers in Q3.” We expect foundry utilization rate in advanced process node in Q3 2025 and wafer shipment across pure-foundry vendor will continue to grow,” added Jake Lai, Senior Analyst, Counterpoint Research.