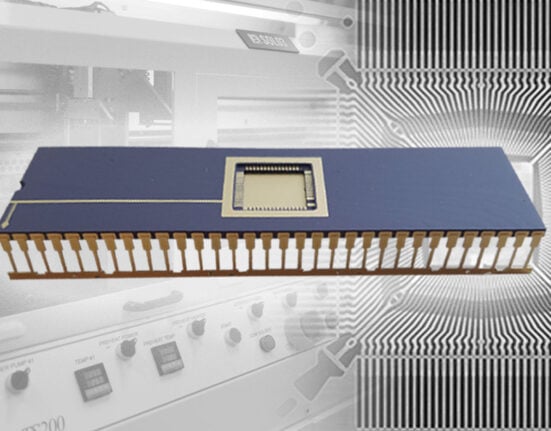

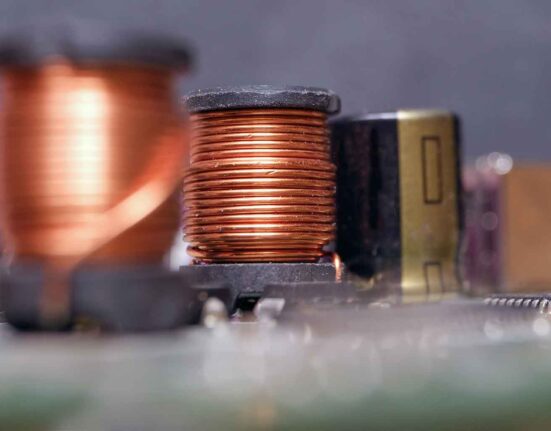

From photolithography, etching, and deposition to assembly and testing, the equipment used to manufacture semiconductors is every bit as sophisticated as the chips themselves. It’s also incredibly expensive.

The $40 million extreme ultraviolet (EUV) lithography machine used to make advanced microchips is the apex predator of the pricing scale. Ironically, the machines building the most sophisticated chips are likely using chips that are generations behind the output of the machines that those older-generation chips control. Thus, even the most advanced semiconductor technologies are subject to the obsolescence of wider line-width chips.

Needless to say, no one is going to want to throw away high-priced manufacturing equipment when a component needs to be replaced. But those machines, many of which are engineered to remain operational for decades, have something in common with other equipment in the industrial space – they’re often running on prior-generation semiconductors. Even the most sophisticated semiconductor manufacturing equipment is likely to need a maintenance procedure at some point, whether a component fails or performance needs to be upgraded. Semiconductor manufacturing equipment is vulnerable to obsolescence as technology advances and original chip manufacturers (OCMs) move on from older components.

Vigilance is a virtue

OCMs strive to give their customers ample notice before retiring a product – generally six months to place a last-time buy and another six months for last-time delivery before production stops. But in a rapidly innovating and highly competitive semiconductor industry, that isn’t always the case. There are several scenarios that can shorten that timeline, from technological advancements to shifting business priorities, supply chain disruptions, and production facility failures. For those managing the varying lifecycles of thousands of intrinsic components, even the most generous end-of-life (EOL) notification runways may not be enough to stave off operational disruption.

While semiconductor equipment manufacturers have been able to rely on an overabundance of buffer inventory of critical parts for several years, that pandemic bloat has largely worked its way out of distributor, end customer, and manufacturer warehouses. As companies are drawing down that inventory, hyperscalers are gobbling up components (not just GPUs and other accelerators) at an astonishing rate to expand compute capacity, and older technologies are being decommissioned to produce higher-margin, advanced components. Vigilance is a virtue in the cyclical semiconductor industry, where overabundance is often followed by scarcity, and the hype of a new era is high.

Ideally, managing obsolescence begins at the equipment design phase as choices are made about which components make it onto the bill of materials. In this respect, semiconductor manufacturing equipment is no different than technologically sophisticated equipment in other industrial settings. Downtime is costly. So are redesigns when replacement parts are unavailable at any price. Wise decisions made early can have a significant positive impact down the road.

Maintaining product continuity as EOL looms

That said, even the most proactive engineers will inevitably encounter EOL issues that leave them scrambling. An authorised distributor that specialises in obsolete and EOL components can be invaluable, giving semiconductor equipment manufacturers reliable and trusted access to hard-to-find parts that are vital to functionality. These authorised distributors work closely with OCMs to understand their product roadmaps and EOL time horizons, integrating factory-direct authorised product lines, proactive end-of-life (EOL) management techniques, and advanced analytical tools to keep surprise shortages out of the equation.

There are also companies that specialise in extended manufacturing services by replacing the OCM in the semiconductor manufacturing supply chain. OCM products are manufactured under license by a third party to maintain product supply continuity, aligning the lifecycles of critical components with the equipment that relies on them. OCMs and their end customers rely on extended manufacturing to ensure parts that are intrinsic to high-value equipment remain available long-term, and that they are fully compatible in form, fit, and function with the original designs. An OCM may initiate the engagement, reaching out as components phase out of production. A semiconductor equipment manufacturer may start the conversation knowing that a critical part is nearing EOL, and procurement becomes an issue. As licensing is secured and manufacturing transfer to the third-party proceeds, bridge buys of finished goods by an obsolescence focused distributor ensure access to components until production ramps up again for genuine, 1:1 drop-in replacements, authorised and licensed by the original manufacturer.

Mitigating risk as obsolescence marches on

Obsolescence is unrelenting. Procurement teams should be under no illusions about the challenges inherent in maintaining a steady supply of essential components. Over 300,000 EOL notices for semiconductor components are issued every year, including FPGAs, power management ICs, PGAs, clock, and frequency generators, and other workhorses running some of the most sophisticated equipment in the world. Proactive obsolescence planning, EOL management, and extended manufacturing services can help semiconductor equipment manufacturers mitigate risk as OCMs prioritise lines that will drive growth over those whose demand and profitability are waning.

About the author:

Duker Dapper, a seasoned semiconductor industry leader, founded Resurgent Semiconductor, now Flip Electronics Manufacturing Services, to extend the lifecycle of legacy semiconductor components, leveraging over three decades of experience in engineering, operations, and business unit leadership. He launched his career at Cypress Semiconductor, steadily rising through the ranks by delivering results and building high-performance teams. His visionary leadership culminated in the successful acquisition of Resurgent by Flip Electronics in January 2023. Today, Dapper serves as General Manager of Flip Electronics Manufacturing Services, where he continues to drive solutions that keep critical technologies in production and help customers stay ahead of obsolescence.