Yole Group announces the publication of its latest market and technology analysis, Thermal Imaging & Sensing 2025.

This report provides a detailed review of the global infrared imaging ecosystem, its evolving applications, and the competitive environment shaped by geopolitical and regional shifts; Yole Group has been investigating imaging technologies for several years.

This new report, Thermal Imaging & Sensing 2025, is part of Yole Group’s imaging collection. Combined with SWIR, MWIR, and Cooled Infrared Imaging 2025, it provides a comprehensive overview of the infrared imaging industry.

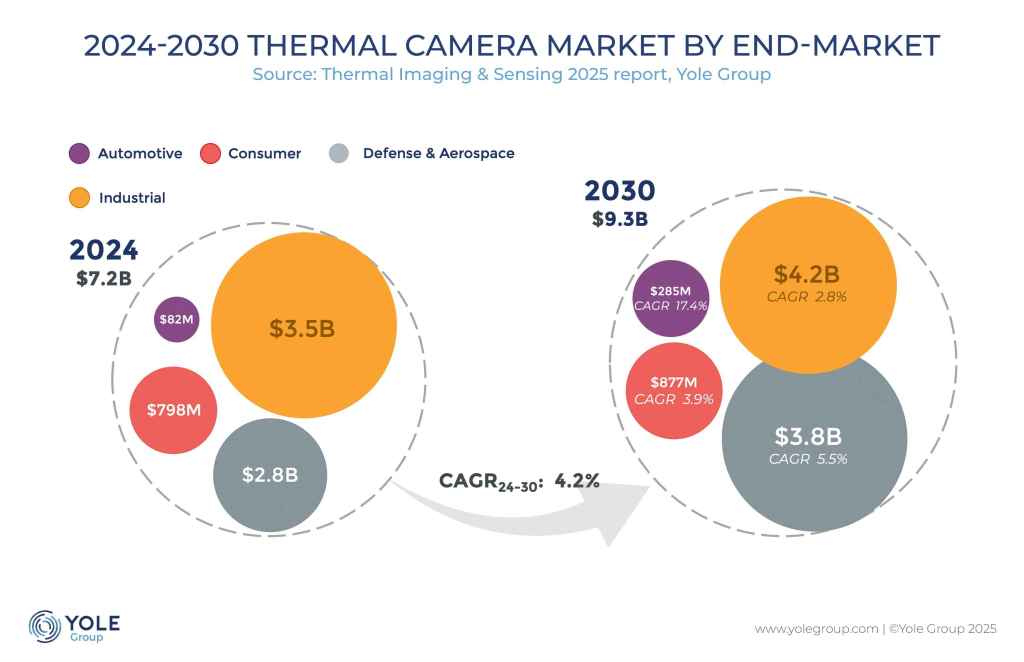

“The infrared imaging industry is supported by a diverse ecosystem of players and technology platforms that span short-, medium-, and long-wave infrared radiation. Infrared technologies are now used across defence, surveillance, industrial, and automotive markets, making them a strategic technology heavily dependent on political decisions. Among them, uncooled long-wave infrared imaging, the focus of this last report, represented the largest volume and generated more than seven billion dollars in revenue,” said Axel Clouet, PhD, Senior Analyst, Imaging at Yole Group.

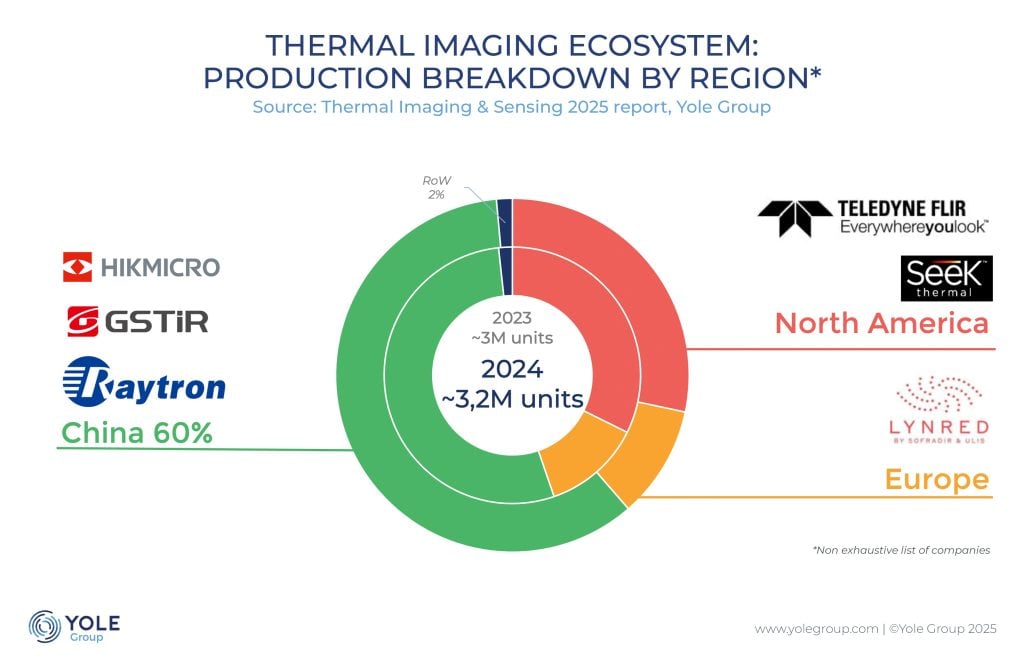

While western countries are placing strong expectations on automotive adoption, Yole Group’s analysts observe that most of the growth in volumes is coming from China, where industrial and consumer segments remain dynamic. In contrast, Western players are concentrating their efforts on defence, surveillance, and other high-value applications.

Imaging market growth: Yole Group highlights regional contrasts and strategic moves

In the new report, Yole Group’s analysts detail market opportunities across defence, aerospace, automotive, industrial, and consumer segments.

Defence and aerospace will reach almost $4 billion by 2030, driven by new light UAV procurement cycles and their strategic importance highlighted by ongoing conflicts.

Automotive is on the rise, with revenues expected to hit $285 million by 2030, supported by US AEB regulations and increasing deployment of night vision in Chinese high-end vehicles.

Industrial and consumer markets are slowing in Europe and North America but remain highly attractive in China, where local manufacturers have established large production capacities.

Yole Group’s analysts also highlight the impact of regional decoupling: although Chinese players Hikmicro and Raytron expanded rapidly in 2024, Western companies faced saturated local markets. Hikmicro and Raytron will present their vision of this industry and detail their expertise with a dedicated presentation at the Yole Group Forum on 10th September.

This decoupling underscores the strategic role of thermal imaging in global supply chains and its direct link to political and defence agendas.