The US is allegedly looking at a policy that would implement a 1:1 chip making ratio whereby semiconductor companies would have to match every chip they import with a chip made in the US, according to reporting first put out by The Wall Street Journal.

If the policy is put through, chip makers will have to match this 1:1 ratio or potentially face tariffs over time. Those who commit to domestic manufacturing would receive credit for the chips these facilities will later make, which will allow them to import chips without tariffs during the construction phase. There may also be further transitional support provided by the US, although it is not known what this will look like.

It belongs to Trump’s wider ambitions to boost domestic manufacturing capabilities and reduce reliance on overseas manufacturing; something that has coloured his second term in office and brought about the introduction of tariffs in April – and, later, the introduction of exemptions from tariffs of 100% on chips, demonstrating the importance of advanced semiconductors to the US.

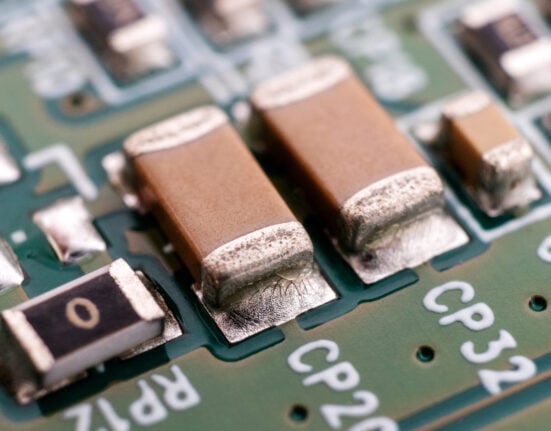

Figures provided by the Semiconductor Industry Association (SIA) in 2024 projected that the US would grow its share of advanced chip manufacturing to 28% of global capacity by 2032, and capture 28% of total capex, from 2024 to 2032.

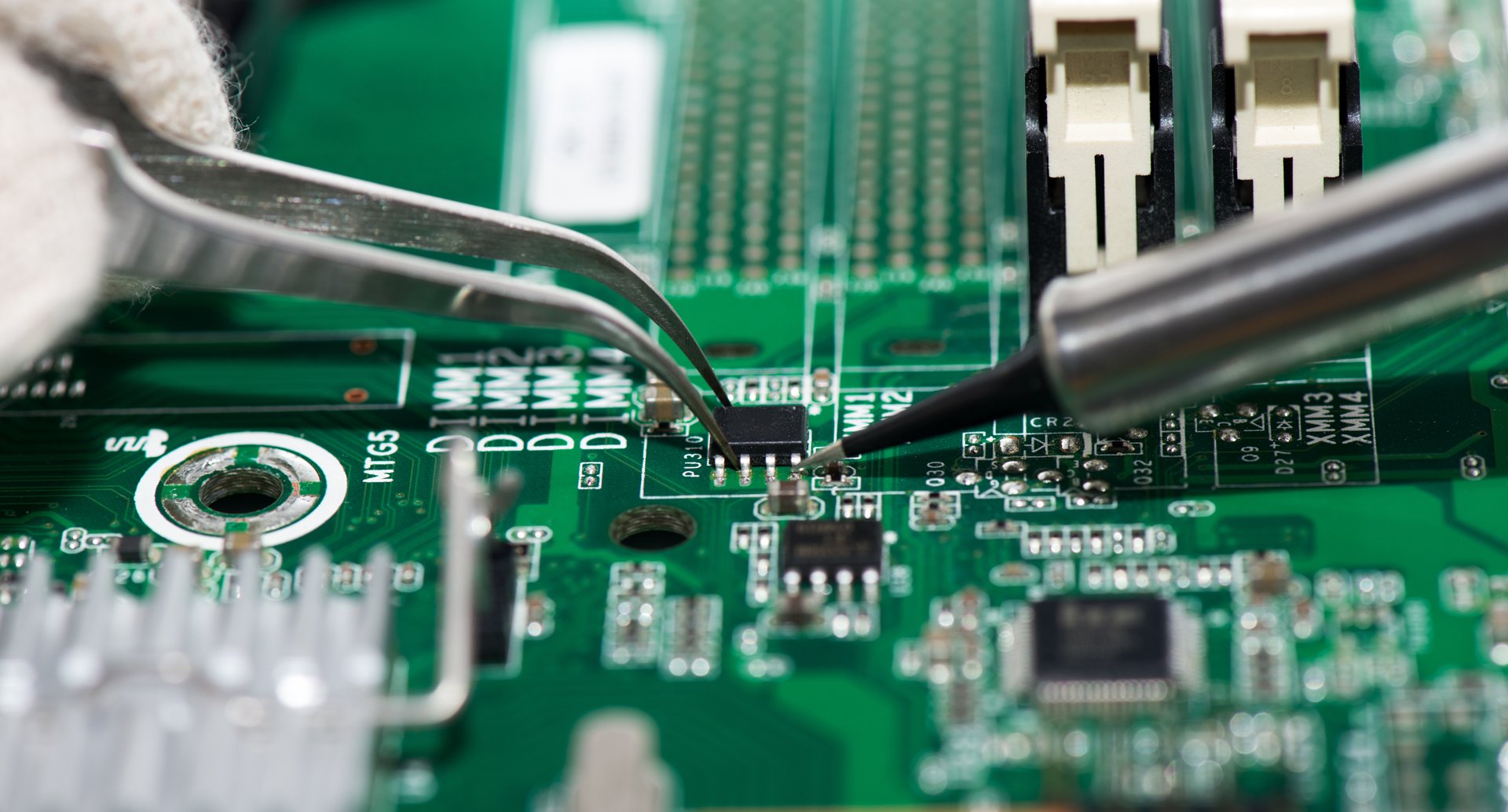

This policy may put in motion a significant increase of domestic manufacturing, although it is not yet clear how this will be policed, and what criteria the administration will use to judge the value of chips. More advanced chips (those below 10nm) are more expensive and complex to manufacture. Domestic chip makers could be tempted to produce less mature and expensive chips.

Those who are set to benefit are chip makers with existing domestic manufacturing capabilities who plan to scale, in line with Trump’s aims. TSMC, for instance, announced investment valued at $165 billion in March and expansion plans for three new fabrication plants, two advanced packaging facilities, and a major R&D centre.

Intel is investing more than $100 billion, supported by almost $8 billion provided by the US CHIPS Act. Intel is arguably the best positioned to support domestic manufacturing as it has fabs in Oregon, Arizona, and Mexico, all of which will receive investments exceeding $36 billion, $32 billion, and $4 billion, respectively.

Those set to lose out, naturally, will be international foundries with large exports into the US market, and companies who are heavily dependent on imports and may not be able to shift production domestically.

The factors that can be measured to measure success include how much time foundries will have to match this 1:1 ratio, if the policy is brought in, the availability of financial incentives, and the technology and node maturity.