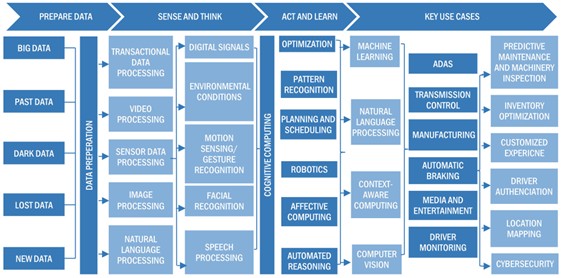

Automotive is an important area of application for artificial intelligence (Al), involving the use of various technologies such as machine learning, natural language processing computer vision, and context awareness.

Self-driving vehicles on trial are equipped with artificial intelligence software and a set of hardware sensors, including LiDAR, video camera, position estimators, and distance sensors. The use of Al in vehicles increases their safety and that of pedestrians and reduces accidents; this has led to the growing demand for Al in the automotive industry. Al finds several applications in autonomous and semi-autonomous driving cars, thus boosting the automotive artificial intelligence (Al) market.

MarketsandMarkets carried out a study to understand the dynamics of the automotive Al market, while estimating and forecasting the size. It also identifies key offerings, technologies, processes, and applications related to automotive Al, in addition to the geographical areas that are expected to provide various growth opportunities for the market.

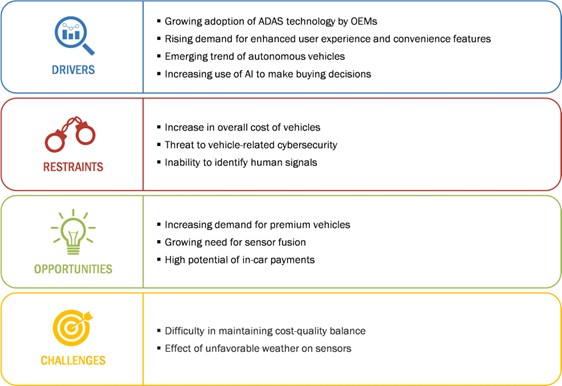

According to MarketsandMarkets, the automotive Al market is expected to reach $7,050.7 million by 2027, at a CAGR of 24.12% between 2022 and 2027. The emergence of autonomous vehicles and industry-wide standards such as adaptive cruise control (ACC), blind spot alert, and advanced driver assistance systems (ADAS) are expected to trigger the growth. The growing demand for convenience and safety also presents an opportunity for OEMs to develop new and innovative artificial intelligence systems. There is intense competition among automotive artificial intelligence system manufacturers with respect to technology, quality, and, most significantly, cost. Most Al applications are complex in nature and consequently very expensive; this is restricting the growth of the automotive Al market, especially in APAC.

The automotive Al market for the software segment was valued at $1,673.7 million in 2022 and is estimated to reach $3,747 million by 2027, registering a CAGR of 17.49% during the forecast period. Software holds a major share of the overall automotive Al market, mostly because of the development of Al software and related tools – Alphabet Inc. (US), Microsoft Corporation (US), IBM Corporation (US), and Intel Corporation (US) are among the frontrunners in the development of Al software for the automotive industry.

There is increasing innovation among companies, leading to new product developments, including both hardware development and software platforms to run deep learning algorithms and programs. For instance, graph core (a UK-based company) is developing an intelligent processing unit (IPU) for machine learning technology for use in applications such as driverless cars. Companies involved in the development of hardware for Al in the automotive industry include Google, Inc. (US), NVIDIA Corporation (US), Intel Corporation (US), Qualcomm, Inc. (US), and IBM Corporation (US).

The deep learning technology segment has the largest share in the automotive Al market and is used in voice recognition, voice search, recommendation engines, sentiment analysis, image recognition, and motion detection. NVIDIA’s DRIVE PX solution for the automotive industry is a combination of various technologies but it uses deep learning at its core.

The automotive Al market for machine learning is expected to be valued at $508.8 million in 2022 and is estimated to reach $1,512.2 million by 2027, at a CAGR of 24.34% during the forecast period. Machine learning has several applications in the automotive industry and is rapidly expanding across a growing number of end markets. Several companies are investing in software to benefit from the combination of Edge processing with Cloud-based data analytics. Mobileye (Israel) and Xilinx (US) use machine learning extensively in their offerings for the automotive Industry.

Growing adoption of ADAS technology by OEMs

Safety is becoming a prime concern in terms of vehicle features. Most accidents occur because the driver is either distracted or has lost focus due to drowsiness. The World Health Organization (WHO) estimates that approximately 1.3 million road traffic deaths occur globally each year. Several driver assistance systems have been developed to assist the driver and significantly reduce the number of accidents. Such systems will warn inattentive drivers of approaching danger and help increase safety.

Driver assistance systems have gained significant importance over the past few years. Hence, the demand for adaptive cruise control (ACC) and ADAS is increasing. The trend is estimated to continue for the next five years. The improving infrastructure, the increasing struggle of automobile manufacturers to offer improved features, and the changing lifestyle worldwide have boosted the overall sale of premium passenger cars.

Emerging trend of autonomous vehicles

Autonomous cars may prove to be the next big evolution in personal transportation. Several companies such as Tesla, NVIDIA, and Intel are engaged in research on autonomous cars with the aim of introducing them to the commercial market. For a car to be completely autonomous, many systems must collaborate to provide a safe ride. Wi-Fi, radar sensors, and GPS play a vital part in the autonomous car. Wi-Fi allows the car to communicate with other cars, while GPS directs car to their destination, and radar sensors warn the car to avoid collisions. The emergence of autonomous cars is expected to accelerate the demand for driver assistance systems in the near future.

The automotive industry is currently going through a major phase of evolution with the introduction of disruptive autonomous vehicle technology. This technology will be applicable in the automotive industry at multiple stages or levels. Autonomous vehicles are self-driven vehicles that are capable of sensing the environment and navigating to the destination without any physical (human) input; they can be operated through voice commands.

Due to numerous features that reduce human effort when driving, such as automatic parking, self-driving, and autopilot, autonomous vehicles are becoming more popular on a global scale. For instance, one of the most sophisticated systems on the market for automotive artificial intelligence is Tesla’s autopilot which includes capabilities like maintaining the vehicle in its lane while driving, automatically changing lanes, when necessary, and self-parking. The use of autonomous vehicles is expected to considerably reduce the need for human intervention; the vehicles will be crucial in sectors that lack sufficient manpower for transportation. This, in turn, is anticipated to fuel the market for automotive Al.

Hardware providers include manufacturers of graphics processing units (GPUs), central processing units (CPUs), field-programmable gate arrays (FPGAs), and application- specific integrated circuits (ASICs), including tensor processing units (TPUs) and deep learning units (DI- US). NVIDIA and Intel are the leading companies providing hardware. Xilinx is the major FPGA provider; other hardware providers are Micron, Microsoft, and IBM.

Key server providers are Microsoft, and IBM. Cloud service providers include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Alibaba Cloud, IBM Cloud, and Oracle.

Overall, the automotive AI market is poised for substantial growth, driven by advancements in autonomous driving, safety technologies, and AI-powered vehicle systems. While deep learning, machine learning, and ADAS are key enablers of this evolution, high costs and technical complexities remain challenges, particularly in emerging markets.

Leading technology firms and automotive manufacturers continue to invest in AI-driven solutions, shaping the future of intelligent mobility. As autonomous vehicles become more prevalent and AI integration deepens, the market will likely see continued innovation, increased competition, and expanded adoption across global regions.

This article originally appeared in the March/April issue of Procurement Pro.